By Rahul Pithadia –

In such harsh summers, the heat begins to rise within the crowd with a question of where to park their funds to get a decent shadow (returns) over their corpus. As per the current inflation rate, everyone wants healthy returns on their investments.

This is possible only when money is invested in decent funds which have a wealthy future ahead. For risk seekers, we have a fund which invests in diversified mid-cap stocks and there is a scope of capital appreciation over long term. Take the decision now because the earlier you start, the larger will be your corpus in future!

Canara Robeco Emerging Equities is the best amongst the small cap & mid cap category and it is ranked 1 by CRISIL. It aims to generate long term capital appreciation through investing in diversifies mid-cap stocks which have higher probability to turn into bigger corporate in the coming future.

Emerging Equities Fund: Daily Chart

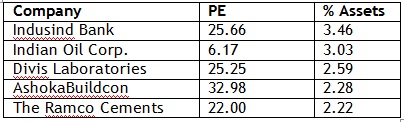

Portfolio Analysis: As per the sectoral holdings Engineering & Capital Goods have been most favored sector for this fund as it is contributing 17.84% to the entire portfolio followed by Banking and Chemicals Sector. Top Holdings and Sector Allocation for this fund are shown below.

Top Holdings:

Returns as on 22nd March, 2016

Risk Profile: The risk associated with this fund is too high because the total investment is focused on the stocks from small caps and midcaps sector. During the corrective phase or bad times this scripts do not have any lower limits to fall which can turn into capital loss. However every coin has 2 sides as these small size companies have potential to turn large which once happens can add bumper returns to your corpus. It is suitable to investors having high risk bearing ability within the age of 20-40 years.

Investment perspective: This fund has maximum exposure to equity and as per our outlook on Indian Equity markets we feel that the corrective action of past months is on the verge of completion and post that the Bull Run should resume which will provide alpha returns. Hence this is the correct time to park your money in this fund through the SIP route.

In a nutshell, this fund looks to be the best amongst the midcap and small cap sectors as it has less exposure to Banking which can turn out to the laggard in the upcoming bull trend. The break of 65 levels will provide excellent opportunities to investors to enter in staggered fashion and ride closer to their goals!

So be cool in this hot summer and get the cool benefits of Online Portfolio access on our website, Free Weekly Research reports, Exclusive Articles, Monthly Account Statements, Easy execution and Expert Advisory – ALL FOR FREE

Click HERE for more details.