By Ashish Kyal –

Generally, we have to work hard to get the consistent inflow of money. However, your hard earned money also needs to work harder to get you more returns. As it is said – Money attracts more money. So why not implement the same. Once a pool of money is generated, we need to assure that the same is invested or reinvested in a better plan that would fetch more money from the existing pool.

At the beginning of the race, you work hard and you need to do that to earn a prominent amount. But, hard work if mixed with smart work can get you outstanding returns. Working hard over the time, can lead to stress and loose interest with your work. So play smart with your hard work.

Your money can also work harder than you, just for you, if you allow it to do so. So, don’t create limits, instead put your money in greater investment avenues which can fetch you prominent returns, like Mutual Funds. Whereas, idle money is just wasting your money, your capacity and the hard work you spent on it.

To name one of them, Birla Sun Life MNC Fund has managed to deliver exceptional returns in the past. Please understand Mutual Fund investments are subject to market risk and past performance does not guarantee future returns, nevertheless, the techniques that we follow to understand future performance are suggesting that there is still lot of juice left in this scheme…

Birla Sun Life MNC Fund is an open ended growth scheme which invests primarily in the small cap and mid cap sector which has high potential in the future.

Objective: To achieve growth of capital at relatively moderate levels of risk by investing in securities of multinational companies through in depth research.

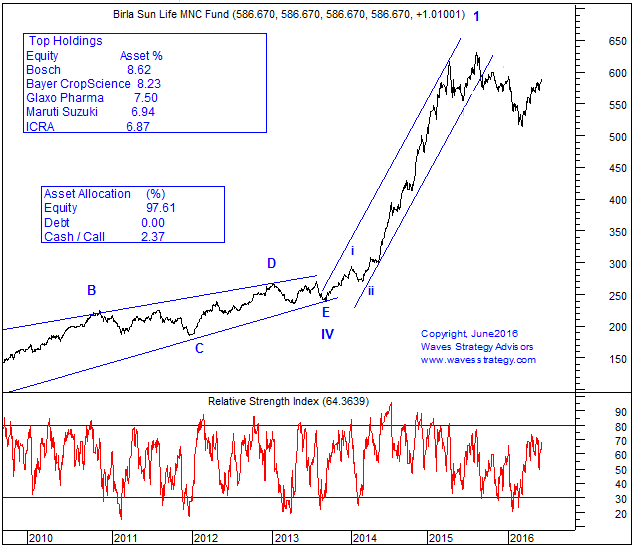

Birla MNC Fund Growth: Daily Chart

Birla Sun Life MNC Fund is an open ended growth scheme which invests primarily in the small cap and mid cap sector which has high potential in the future.

Objective: To achieve growth of capital at relatively moderate levels of risk by investing in securities of multinational companies through in depth research.

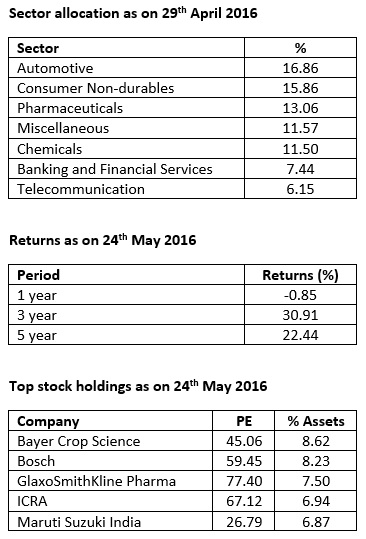

Portfolio Analysis: This fund invests 38.16% in the top 5 holding which are mentioned below –

In a nutshell, if we look at the history this fund has given promising return from the levels of 23 to 640 and also has inherent potential ahead. Investments through SIP will be the best route to travel the journey. Lump sum investments can be made above 600 levels which will give a positive gate pass to the bull trend which is in sync with our outlook on Indian markets!

Risk Parameters: As the investments are made in the small cap & mid cap stocks the risk associated with this fund is high but as they are MNCs the tank period will not be of much pain.

Reach out to us to get Free Expert Advisory, Weekly Research Reports, Monthly Account Statements, Online Portfolio Management and much more User-Friendly Services. Contact Us HERE