UTI Equity Fund:

UTI Equity Fund Growth is an open ended fund having eyes on large cap stocks and approximately 98.13% exposure to Equity instruments.

Portfolio Analysis: As per the sectoral holdings Banking/Finance have been most favored sector for thisfund as it is contributing 32.22% to the entire portfolio followed by Automotive and Pharma Sector.

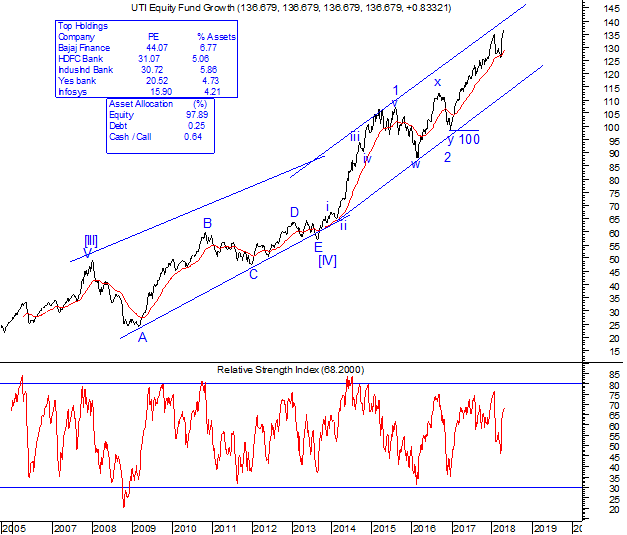

Top Holdings and Sector Allocation for this fund are shown below.

Top Holdings:

| Company | PE | % Assets |

| Bajaj Finance | 46.56 | 6.77 |

| IndusInd Bank | 31.02 | 5.86 |

| HDFC Bank | 26.97 | 5.04 |

| Yes Bank | 19.00 | 4.73 |

| Infosys | 15.64 | 4.21 |

Sector Allocation:

| Sector | % |

| Banking/Finance | 32.22 |

| Automotive | 9.85 |

| Pharmaceuticals | 11.99 |

| Technology | 11.55 |

| Engineering | 4.94 |

Returns: As on 31st January, 2018

| Period | Returns% |

| 1 year | 19.77 |

| 3 year | 8.39 |

| 5 year | 17.00 |

Risk Profile:This fund has complete exposure in Equity instruments hence we consider this fund as High Riskhence only Risk taking investors should invest in this fund.

Technical Perspective:The weekly Chart for UTI Equity Fund Growth shows that post completion of wave 2 near 100, prices exhibited a sharp move on upside in form of wave iii. Also the 20 weeks EMA is now acting as support to the prices which indicate positivity in the trend. Prices can move up towards 160 levels where the channel resistance is placed.

In a nutshell, entering in this fund in staggered fashion would be advisable at current level. As this is a large cap fund combining this with other small cap, midcap or debt investments would help fetch good returns, it is advisable to balance portfolio and also provide the benefits of diversification.

Invest NOW in UTI Equity Fund Equities Fund online – Click here