By Ashish Kyal –

We have a large number of Investment options. Every option provides some or the other way, an extra per cent of return surplus from the regular income that we earn for our daily bread and butter. But all the options don’t turn up good in terms of overcoming the Inflation rate.

Inflation Rate always increases with a normal hike of around 6 to 7%. So, how do we cover the inflation rate from our investments to get a good percentage value after deducting the same from the returns?

The below Info-graph shows the effect of Inflation rates on our investments –

Thus, to cut the inflation out of our expected returns, we need to save in Equity linked schemes and funds as we get a compounded rate of return in the long run which defeats the inflation rate to a major extent.

Here’s providing you with a fund suited for your Long Term Investments –

Birla Sunlife MNC Fund is an open ended growth scheme which invests primarily in the small cap and mid cap sector which has high potential in the future.

Birla MNC Fund Growth: Daily Chart

Objective: To achieve growth of capital at relatively moderate levels of risk by investing in securities of multinational companies through in depth research.

Portfolio Analysis: This fund invests 38.04% in the top 5 holding which are mentioned below

Top Holdings:

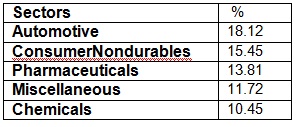

Sector focus: It provides interesting insights, Banking sector is not included in this fund which is a decent move as there are other outperforming sector which are relatively good compared to the PSU Banks which has shown sharp depreciation in its price.

Sector Allocation:

Risk Parameters: As the investments are made in the small cap & mid cap stocks the risk associated with this fund is high but as they are MNCs the tank period will not be of much pain.

In a nutshell, If we look at the history this fund has given promising return from the levels of 23 to 640 and also has inherent potential ahead. Investments through SIP will be the best route to travel the journey. Lump sum investments can be made above 600 levels which will give a positive gate pass to the bull trend which is in sync with our outlook on Indian markets!

Thus, create a cover for the inflation rate by investing in Mutual Fund through us and get access to Free Weekly Reports, Exclusive Articles, Monthly Account Statements, Expert Advisory and Online Portfolio Access.

Click HERE for more details