Thematic funds are basically those in which investments are made looking at the theme of a particular sector. The crash in the banking sector suggest that now particularly banks will continue to face the bad times and on the other hand Automobile, chemicals, textile are the sectors which should gradually outperform.

The below mentioned fund helps in providing decent returns as it is focusing on a particular theme which is doing business with infrastructure construction projects , cement , steel etc. However the risk associated is too high as the investments are made in a particular sector and if that doesn’t click then the chances of loss of capital are more.

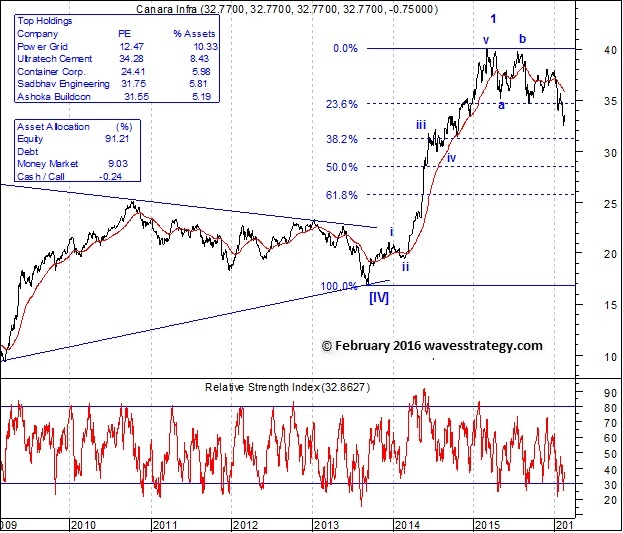

Canara Robeco Infrastructure Fund-Growth Daily chart:

This Scheme invests in equities and equity related instruments of companies in the infrastructure sector. Out of the total Equity investment around 40% is into Engineering & Capital goods and Cement & Construction.

Portfolio Analysis: Canara Robeco Infrastructure Fund is a thematic fund which is designed to invest in shares of those companies, which hold high potential to benefit from such infrastructure Index.

Risk Profile: Being a thematic scheme there is no diversification and dependency is only on a particular sector. This makes the fund highly risk because some sectors may perform well while the others might face the bad times.

When is the right time to enter? So now from investment perspective, a down move towards 30-35 levels is plausible in this fund. The reason behind it is that Infra sector has corrected post making a high in July 2015 and it is continuously exhibiting lower high lower lows with no sign of relief as of now so it is advisable to avoid fresh investments in this fund from medium term perspective but it can be clubbed with other equity funds for better diversification and risk reduction.