The first question that arises is What is volatility ? It is the regular change in the value of a particular asset which can be either in favor or against. Its one of the major factor which people are afraid of while making investment and a common tendency states that volatility will lead to fall or have negative impact on investment the point is that such fluctuation take your investment up as well as down and the ones which never ever falls will never ever fly. Three major solutions to avoid or reduce the risk of volatility are as follows:

Long Duration Investments: This would give that extra cushion of time to your investment thereby reducing the impacts of small fluctuations.

SIP: Investments are made in different time cycles which end up with the benefit of cost averaging.

Diversification: The erratic moves in the equity markets, especially in the small caps are ignored when they are clubbed with other mid cap and large cap stocks to avoid.

ICICI Prudential Value Discovery Fund: Daily Chart

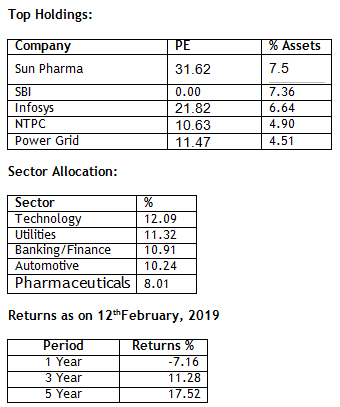

ICICI Prudential Value discovery fund is an open ended diversified equity fund, which aims at stocks which are available at a discount to their intrinsic value through a process of ‘discovery’ this process is called as Fundamental research. This process involves identifying companies that are well managed, fundamentally strong and are available at bargained price.

Risk Profile: The risk is moderate in this fund as the investment is diversified among various assets. Average returns can be expected from this fund as it is outperforming at current levels. Investors looking forward for good returns with moderate risk should consider this fund for investments in staggered fashion or through SIP route.

Technical Perspective: Above daily chart of ICICI Prudential Value Discovery Fund shows that post the completion of wave 2 near 100 levels, prices have completed wave 3 on upside and currently wave 4 is ongoing which is the best time to invest into to capture the up move in form of wave 5.

In a nutshell, corrective action in this fund looks to be more of time rather than price so investments in staggered fashion is advisable and SIP should turn out to be the best way as it will provide excellent cost averaging opportunities.

Invest NOW in ICICI Prudential Value Discovery Fund online – Click here