By Ashish Kyal – There’s nothing like a good-luck period for investing when you prefer mutual funds as your investment option, as they give better results if they are kept for long tenures.

But still, if you still ask for an exact period when one should enter through Mutual funds, is the time when Markets are down and NAVs have touched the ground level. Because that is the time when you expect the markets to grow up and recover. And just before that is a good time to get in as low NAV fetches you more Units.

After getting the Units, you just have to wait and watch the game with patience. The longer are your investments, the greater you earn. Also, you can visit our earlier Article – Give Time to your Investments, rather than Timing for more insights under this section.

Also, one more question wondering must be – Best Time to Redeem!

Your money will never stop compounding. So keep it until you don’t need it. Otherwise, your Future dreams are valid enough to make you redeem your investments.

Thus, invest in by getting in depth knowledge about a fund’s portfolio and its risk profile along with its research based on Elliott Wave Analysis as shown below –

UTI Equity Fund Growth Weekly Chart

UTI Equity Fund Growth is an open ended fund having eyes on large cap stocks and approximately 95% exposure to Equity instruments.

Portfolio Analysis: As per the sectoral holdings Banking/Finance have been most favored sector for this fund as it is contributing more than 20% to the entire portfolio followed by Automotive and Technology Sector. At stock level the fund has diversified holdings into 76 stocks with Top 5 stocks contributing 23.06% to the entire portfolio.

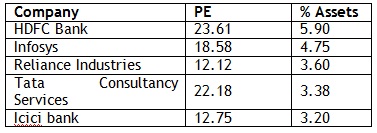

Top Holdings:

Returns as on 15th September, 2015

Risk Profile: This fund has complete exposure in Equity instruments hence we consider this fund as High Risk hence only Risk taking investors should invest in this fund once the corrective action gets complete.

In a nutshell, this is not the right time to enter in this fund because we still expect deeper retracement towards 90 levels which will provide good entering opportunities on handful of positive confirmations. Till that time Investors can park their money in debt funds which will help them fetch some returns and once the clear trend in equity emerges investors can switch to Equity Systematically.

Get access to Online Portfolio on our website, FREE Research Reports, Easy Execution, After Sales Services and Expert Advisory.

Click HERE for more details.