By Rahul Pithadia –

All the investment avenues available in the market have their strengths and weaknesses. Some options seek to achieve superior returns (like Equity) but corresponds higher risk. On the other hand others are safe heaven (PPF, FD) but at the cost of growth and returns.

Mutual funds seek to combine the advantages of investing in the arch of these alternatives while dispensing with the shortcomings. Here are the options of diversification depending upon the risk taking capacity and also attractive valuations. In case of emergency, funds can be redeemed 24/7 with just a minor burden of 1% exit load. As the investments are made by market experts hence they can easily predict the markets and make the investors invest wisely.

This suggests that there are en number of benefits with mutual funds and to solve your problems to an extent below is the fund which looks to be promising in the coming years.

ICICI Prudential Value Discovery Fund: Daily Chart

ICICI Prudential Value discovery fund is an open ended diversified equity fund, which aims at stock which are available at a discount to their intrinsic value through a process of ‘discovery’ this process is called as Fundamental research. This process involves identifying companies that are well managed, fundamentally strong and are available at bargained price.

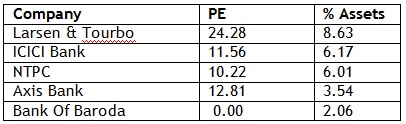

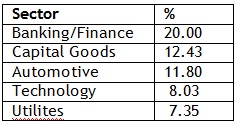

Portfolio Analysis: As per the sectoral holdings Banking/Finance have been most favored sector for this fund as it is contributing 18.22% to the entire portfolio followed by Automotive and Technology Sector. Top Holdings and Sector Allocation for this fund are shown below:

Top Holdings:

Sector Allocation:

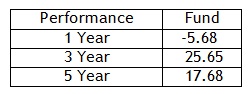

Returns as on 29th March, 2016

Risk Profile: The risk is moderate in this fund as the investment is diversified among various assets. Average returns can be expected from this fund as the corrective phase of the market looks to be complete now we need to wait for prices to confirm. Investors looking forward for good returns with moderate risk should consider this fund for investments in staggered fashion or through SIP route.

In a nutshell, corrective action in this fund looks to be complete so investments in staggered fashion is advisable and SIP should turn out to be the best way as it will provide excellent cost averaging opportunities.

Don’t let your money sit idle! Do more with it. And get more of it!

Start your investments here. Reach out to us to get Free Expert Advisory, Weekly Research Reports, Monthly Account Statements, Online Portfolio Management and much more User-Friendly Services.

Contact us for more details.